NIGERIAN households are currently struggling to meet daily feeding needs, driven by higher prices of food items and increased transport fares as Nigeria’s annual inflation rate rose to 24.08 per cent in July.

Media reports suggest that the higher inflation rate, which represents 1.29 percentage points from 22.79 per cent in June, was caused by an increase in prices of food items, including oil and fat, bread and cereals, fish, potatoes, yam and other tubers, fruits, meat, vegetables, milk, cheese, and eggs.

As a result, food inflation rose to 26.98 per cent, the highest level in 18 years since September 2005, and worsened by the impact of fuel subsidy removal and continued depreciation of the naira.

Also, reflecting the impact of fuel subsidy removal on the cost of transportation and related services, core inflation (all items less farm produce and energy) rose to 20.47 per cent in July, the highest in 19 years, up by 0.41 percentage points from 20.06 per cent in June.

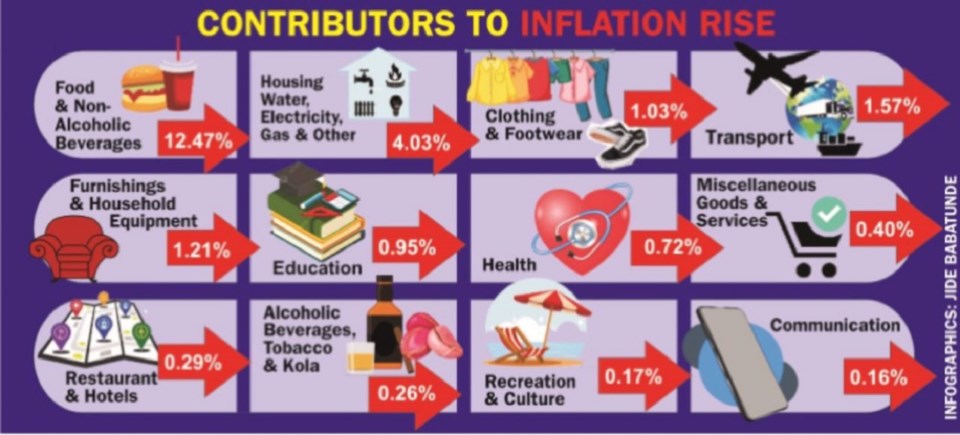

Disclosing this in its Consumer Price Index report for August, the National Bureau of Statistics said that increases in prices of food and non-alcoholic beverages were responsible for most (12.47 per cent) of the rise in the headline inflation rate to 24.08 per cent in July, followed by housing water, electricity, gas & other fuel (4.03 per cent); clothing and footwear (1.84 per cent); transport (1.57 per cent); furnishings, household equipment and maintenance (1.21 per cent).

The NBS said: “In July 2023, the headline inflation rate rose to 24.08% relative to June 2023 headline inflation rate which was 22.79%.

“Looking at the movement, the July 2023 headline inflation rate showed an increase of 1.29% points when compared to June 2023 headline inflation rate.

“On a year-on-year basis, the headline inflation rate was 4.44% points higher compared to the rate recorded in July 2022, which was 19.64%. This shows that the headline inflation rate (year-on-year basis) increased in July 2023, when compared to the same month in the preceding year (i.e., July 2022).

“In addition, on a month-on-month basis, the headline inflation rate in July 2023 was 2.89%, which was 0.76% higher than the rate recorded in June 2023 (2.13%). This means that in July 2023, on average, the general price level was 0.76% higher relative to June 2023.

“The percentage change in the average CPI for the twelve-month period ending July 2023 over the average of the CPI for the previous twelve-month period was 21.92%, showing a 5.17% increase compared to 16.75% recorded in July 2022.’’

Commenting on the latest inflation figures, Dr Muda Yusuf, Chief Executive Officer of the Centre for Promotion of Private Enterprise, CPPE, said while the fuel subsidy removal and naira depreciation were the dominant factors behind the hike in the inflation rate, he stressed that the development had had a devastating effect on citizens’ welfare and the health of small businesses.