ONE stands to discover infinite absurdities whenever one decides to take a close look at financial management in the Nigerian government. For instance, the generation —and subsequent redistribution— of wealth in this federation is blighted by inequality.

To put it in plain words, a few states are creating the bulk of the revenue that the majority of states are spending. Lagos is unsurprisingly amongst the few states generating a larger chunk of the Value Added Tax collected in Nigeria, but it becomes surprising when the actual figures are revealed.

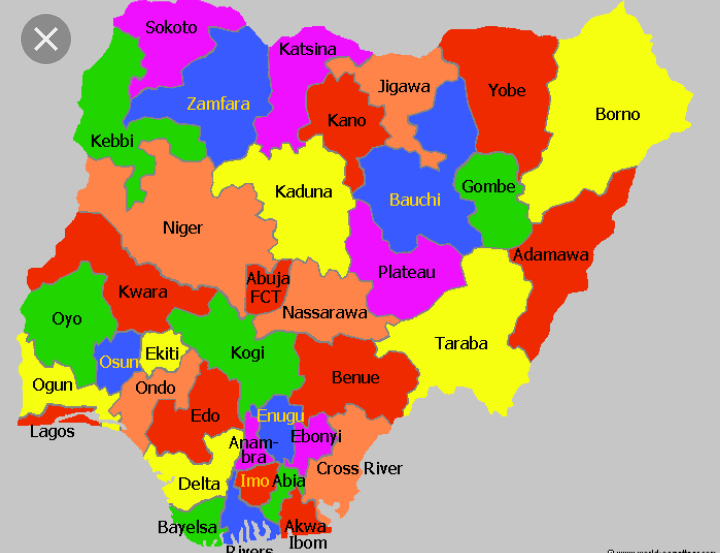

At one point, the former Finance Minister, Kemi Adeosun, reported that the VAT from Lagos State accounted for 55 per cent of the VAT collected in the whole of Nigeria. A country with 36 states and a Federal Capital Territory! She went on to make a clearer picture of the Nigerian VAT pie chart by stating that while the Federal Capital Territory generates 20 per cent, Rivers and Kano states have six per cent and five per cent of the total VAT respectively. What makes this report so ludicrous is the fact that Lagos, Abuja, Rivers, and Kano represent 86 per cent of the VAT collected in Nigeria while the other 33 states manage a meagre 14 per cent. To think that the FCT bests 33 states combined in VAT generation is unbelievable, but this is Nigeria where there are no impossibilities.

Aside Company Income Tax, of which Lagos has constantly represented over 60 per cent in the last decade or so, individual tax payments from residents of Lagos have always topped the list with no less than N10 billion per annum. Lagos is indeed performing exceedingly well in comparison to the other states of the federation.

In Nigeria, the sharing formula is another vague construct of the federal government and some of the states of the federation are beginning to act as pampered kids. It is reported that Lagos gets a larger share of the monthly allocation from the centre, which is commonsensical of the federal government. However, the sharing becomes very bothersome when, in the month of February, Kaduna State got a N4.23 billion allotment while Kano and Rivers got N1.66 billion and N1.33 billion respectively. It is to be noted, at this point, that Kaduna state accounts for just around one per cent of the VAT collected from all states of the federation. Even if Governor Nasir El-Rufai is going to dispute the lowly figures reported, I am very interested in how he proves that Kaduna state should be for once given allocation worth more than those of Rivers and Kano (states which obviously surpass the contributions of Kaduna) combined. This is where states begin to question this federation system and perhaps it is the source of a more determined call of restructuring the way the country is being run.

The way VAT, a tax levied on goods and services consumed, is shared among the three tiers of government is partly responsible for this though. The total VAT collected is redistributed with 15 per cent going to the Federal Government, 50 per cent to the state government, and 35 per cent going to the local government. The picture becomes clearer when you see that most of the states in Northern Nigeria have greater numbers of local government areas. Imagine Lagos and Kano states both starting with 20 LGAs in 1967 only for Lagos to remain the same while Kano has been split into 44 LGAs —even as Lagos is actually more populated. These LGAs were created based on the land mass of these states and gives the North leverage when receiving allocation by the federation’s sharing formula.

It appears that some northern states are more enthusiastic about taking a good bite of the national cake without contributing to its preparation. Why should Sharia practising states which have destroyed thousands of beer crates, notably in 2013, 2015, and 2021, receive a share of VAT on alcoholic beverages? Why should states producing little or nothing get compensated handsomely? There is no way such an unjust system of uneven redistribution of wealth will help Nigerian states mature as they ought

.png;w=120;h=80;mode=crop)